Payoneer Review 2021: How to Accept Payments for Your Digital Products?

Who Needs a Payoneer Account and Why

Firsts things first, you have to figure out whether this very payment method is for you. So who would benefit from having a Payoneer account? Well, these are the following groups of people:

Freelancers;

Entrepreneurs;

People who travel a lot;

People who prefer to shop online.

Let us take a closer look at each of these groups and figure out how exactly they benefit from using this payment service.

Freelancers

Most freelancers work from home, which means that they have an opportunity to work for an international company or the one that does not have an official affiliate in their country. Thus, most of them are having difficulties receiving money through their local banks. Payoneer is an international company that cooperates with hundreds of banks all over the world, which means that receiving money through this very platform and withdrawing it to your local bank account is fast, easy, and in many cases free. This makes Payoneer a perfect choice for pretty much all the freelancers all around the globe.

Entrepreneurs

Quite often entrepreneurs run their businesses internationally and the reason for this is very simple – they get more profits. Being one of the most beneficial international financial services, Payoneer is a good choice for every company that has branches abroad. With that being said, this very service is a rather suitable solution for entrepreneurs.

People who travel a lot

Travelers spend a lot of their time abroad, which may lead to some difficulties with payment methods they utilize there. Sometimes banks have strict limits on the amount of money you can spend abroad or have huge commission fees. Payoneer is way simpler to use abroad, which makes it a splendid option for all the travelers out there.

People who prefer to shop online

Online shopping is exciting and it’s even more exciting when you shop from overseas stores. Of course, you can use your local bank card for online shopping, but if you want to purchase something from a British store and you live in Australia, for example, you might have some issues with your bank. As a result, the process of your payment will take more time and you’ll get your goods at least a couple of days later than you expected them to be delivered. With Payoneer, you will not have such problems. Yet note that not every online store has an option to pay for your goods via Payoneer.

As you can see, a lot of people who have different lifestyles might benefit from having a Payoneer account, so why don’t you go ahead and register? It’s completely free and takes only a few minutes.

Everything You Need to Know about Payoneer Card

Payoneer card is a plastic card, just like the one you’ve got form your local bank, which can be used for withdrawing cash from ATMs, online shopping, paying by card in restaurants, cafés, cinemas, shops, and pretty much anything else you use your regular card for.

You can order a card after you received the first money transaction on your Payoneer account. The card will be sent to you by mail and this service is completely free. Usually, the delivery takes about 1-2 weeks.

If the card does not arrive for a long time, you can contact the support service and clarify the status of the sending. If for some reason the card is lost, it will be sent to you again. Until you activate the card in your account, this is a useless piece of plastic, so don’t worry if it gets lost.

While getting a card is completely free, you’ll have to pay for its service, which is $ 29.95 per year. However, getting a card is not a must for everybody, so you can totally use the service without a card. For instance, you can withdraw up to $10,000 per one transaction directly to your local bank card. Moreover, many banks do not take any commission fees for these transactions. So you can avoid paying the cost of card services, and you will only pay a fee for the transfer (if there is any). Though keep in mind that some features are available only for the cardholders.

Payoneer Review 2021

Availability in 200 countries, 4 million users, payments in 150 currencies… I am sure you have already figured out that today we will talk about Payoneer, a large and successful financial business worldwide. If you are a business owner, consultant, or specialist, the issue of receiving payment is critical for you. Transferring your funds quickly, safely, and inexpensively are main principles of Payoneer.

Payoneer is an American payment company founded in 2005 that facilitates online payment transfers both within the United States and internationally. At the moment, Payoneer has several hundred partner companies around the world (Airbnb, Upwork, Amazon, etc.), which allows you to officially receive payments from them on your card.

If you are looking for financial solutions for your business, whether you send/receive online payments domestically or internationally, Payoneer is your #1 choice.

Video About Payoneer

Ready to conquer the world?

Payoneer vs PayPal: Why You Should Use Payoneer

Today, payment services are an integral part of online trading. Most online platforms offer to withdraw funds through PayPal and Payoneer. Availability of these payment options on the website of the online store is a certain indicator of the quality and integrity of the seller. Let’s compare Payoneer and PayPal services to check which one is the best solution to choose.

| Payoneer | PayPal | |

| Year of establishment | 2005 | 1998 |

| Number of active customers | 4 million | More than 179 million |

| Service | Provides solutions for professionals and businesses to send and receive payments globally. | Operates as an acquirer, performing payment processing for online vendors, auction sites, and other commercial users. |

| Company size | Small business Large enterprises Medium business Freelancers |

Small business Large enterprises Medium business |

| Transfer type | Online Phone assistance |

Online Only |

| Coupon | Free $50 Coupon. | – |

| Fee | Receiving FREE / 1% | 0.005% + +4-5% approx above market exchange rate |

| Pricing model | Quote-based | Monthly payment |

| Convenience | With Payoneer MasterCard, you can access your funds at any time, at an ATM near you. | With PayPal, you can withdraw money back to your bank account, or use it to make payments directly from your PayPal. |

| Speed | 0 – 3 Days | 0 – 3 Days |

| Regular payments | – | – |

| Mobile app | + | + |

| Min transfer amount | Varies Per Customer | $0 |

| Travel debit card | + | – |

| Global bank accounts | + | – |

| Languages supported | English Turkish Dutch Polish Swedish |

English |

| Integrations | Payoneer’s API enables businesses and professionals all over the world to pay and get paid within their platform. | PayPal Pro integrates with the following businesses:

|

| List of features |

|

|

To summarize, both services fill a need. While the companies offer similar capabilities, Payoneer has a stronger focus on international transactions and claims to offer lower overall costs than its competitors. As you can see, they still differ in their fee structure, interactions with your accounts, international availability, and etc.

Payoneer has the edge over PayPal when you have to make larger transactions. In the case when you need to get a payout from online platforms, Payoneer comes out more profitable and fast. Join millions of businesses and professionals receiving cross-border payments via Payoneer to evaluate its benefits in full.

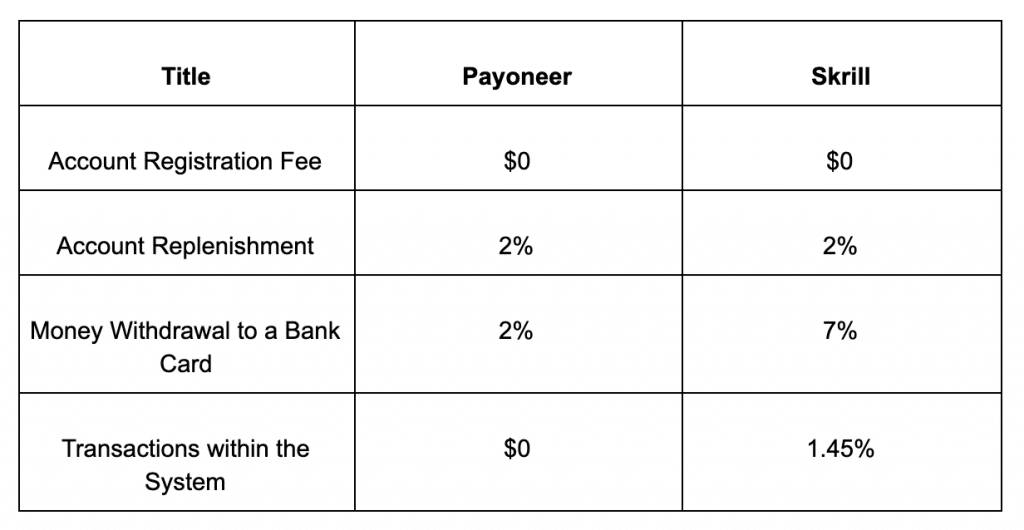

Payoneer vs Skrill

We have already compared Payoneer with PayPal and we have seen that Payoneer is a way more profitable service than PayPal. But what about another popular service such as Skrill? Well, just take a look at this comparison table you’ll see all the cons and pros.

Well, I guess it’s pretty much clear which platform wins this battle.

Payoneer Login: How to Register a Payoneer Account

To take advantage of all the benefits of the payment system, you should register your Payoneer account. Your decision should be conscious since all the data of the new client is checked, and any discrepancies can lead to cancellation of the application.

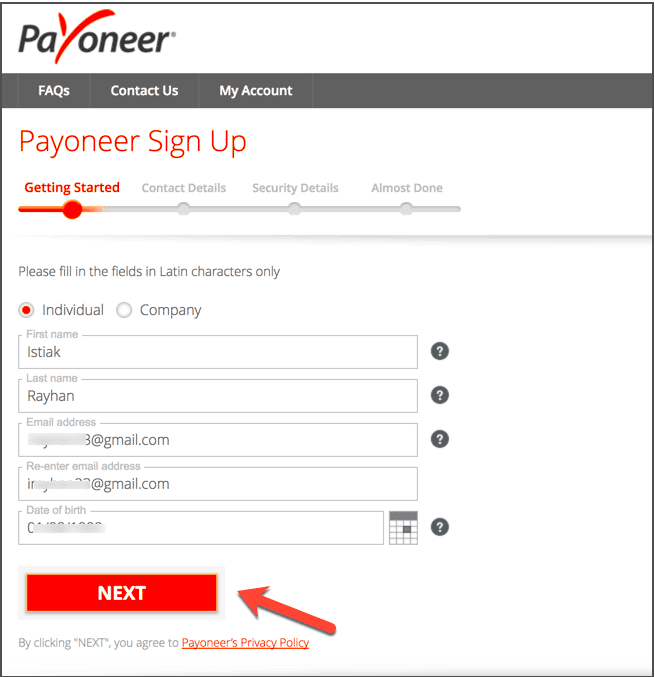

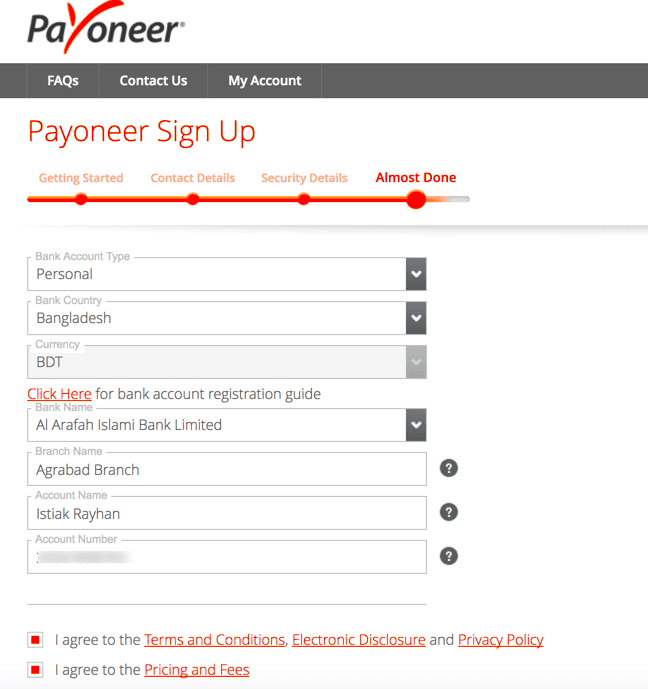

- Go to Payoneer.com and click on ‘Sign Up’ button ( with our referral link you’ll earn $25).

- Specify your name/e-mail address/date of birth in the form suggested. Click ‘Next’ button after.

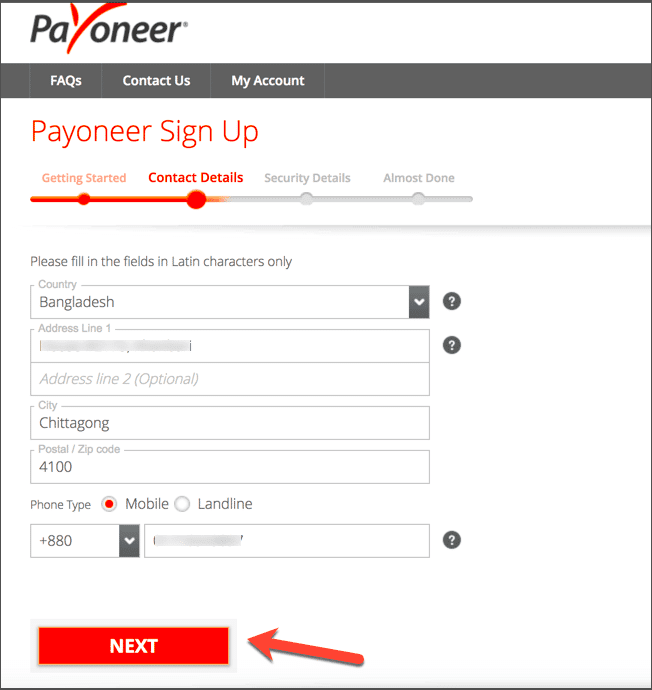

- Fill in the next fields with your contact address and click ‘Next’.

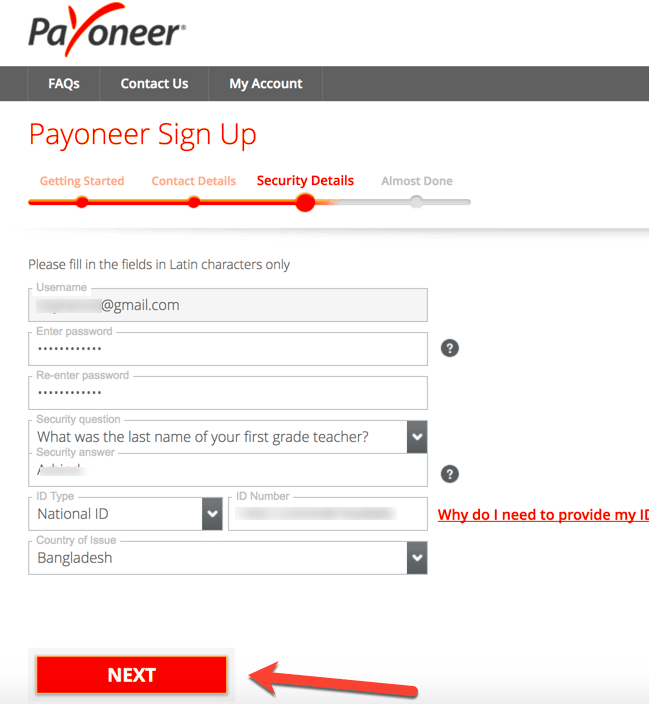

- Specify a password and a security question. This information will help you to retrieve the password if forgotten.

- Provide your bank information and click “Submit”.

After, Payoneer will review your application and send you an e-mail with approval. Once this e-mail is received, you will need to activate your account.

- Login to your account using your Username and Password.

- Click ‘Activate’ button.

- Enter the 16 digit card number from your newly received card.

- Choose 4 digit PIN that you will be using in ATMs and stores.

- Click ‘Activate’ button and wait for the e-mail confirming your activation.

Now you are ready to start using your Payoneer account.

Payoneer Fees

| RECEIVE PAYMENTS WITH PAYONEER | From Another Payoneer Customer | USD | EUR | GBP | JPY – Free |

| Via Receiving Accounts | EUR | GBP | JPY | AUD | CAD| MXN – free USD – 0-1% (fee varies by country) |

|

| Directly From Your Customers | Credit Card (all currencies) – 3% eCheck (USD) – 1% |

|

| Via Marketplaces & Networks | Fees set by each marketplace or network may vary. Please check their website for precise rates. | |

| MANAGE YOUR FUNDS | Withdraw Funds From Your Payoneer Account To Your Local Bank Account | up to 2% |

| Withdraw Funds From Your Payoneer Account To a Bank Account in The Same Currency | USD – $1.50 EUR – €1.50 GBP – £1.50 |

|

| Manage Currencies With Payoneer | 0.5% of amount to transfer. Fees are automatically calculated so you always know how much money you will receive. |

|

| PAY | Pay Your Service Providers With Payoneer | eCHECK – 1% CREDIT CARD – 3% LOCAL BANK TRANSFER -1% |

Funds Withdrawal from MasterBundles to Payoneer

MasterBundles works with vendors from all over the world. The funds withdrawal process from MasterBundles to Payoneer for vendors is in no way different from any other marketplace.

You will need to send a payment request to our vendor communication manager via email and within 3-5 days we’ll make a payment. That’s it!

Moreover it is much easier for us to make a withdrawal of money on Payoneer than on Paypal. Payoneer accepts payments in USD, EUR, GBP, JPY, AUD, CAD & MXN – as if you had your own local bank account! Don’t have a Payoneer account yet? Sign up now and earn $25

How to Withdraw Funds from Payoneer Card

If you have already received funds to your Payoneer account, go ahead and withdraw your funds.

- Login to your Payoneer account.

- Choose Withdraw >> To Bank Account from the menu.

If you have not yet added a bank account to withdraw your funds to, you will see a page with guidelines on how to add a bank to your Payoneer account. - Select the currency balance or card you want to withdraw funds from.

- Enter the withdrawal details

- Select the bank account you want to withdraw funds to.

- Enter the amount you want to withdraw. Note your available balance, displayed at the top of the page.

- If you wish, you can enter a description for your records. This is not a mandatory field.

- Click Review button to check the withdrawal summary.

- Check it out properly and mark the checkbox ‘I approve this transaction’ and click ‘Withdraw’.

You will receive an email confirmation after completing the withdrawal, and your funds will be available in your account within 3-5 business days.

Final Thoughts

Payoneer service becomes more and more popular every year. Existing and new services, one way or another related to eCommerce, include Payoneer as an effective method to withdraw funds. Payments from foreign companies are made without territorial restrictions: it does not matter where in the world you are. This method of money transfers is especially in demand among freelancers and other professionals who work worldwide.

Is Payoneer safe? Absolutely! So far, Payoneer has earned an impeccable reputation. It is known as a responsible and reliable company focused on quality customer satisfaction. Today, Payoneer services are used by millions of people from more than two hundred countries and hundreds of companies of international level. Start using Payoneer to enjoy all the benefits of this company!

When it comes down to it it’s Payoneer that we would have to recommend if you’re looking for the best online payment processor to use for sending and receiving payments as well as being able to access your money.

We’ve been using Payoneer for about 3 years now and we’ve had a wonderful time with the service they offer without any complaints regarding customer service or payment issues.

Visit Payoneer.com and Sign Up Now to Receive $25!

FAQ

💵 How much is a registration fee?

The registration is completely free, no fees are required, so you should never be afraid of that.

💴 How long is the registration process?

It takes just a couple of minutes to fill in the forms and up to 48 hours for the system to confirm your application and activate your account. So it’s fast and pain-free plus you wouldn’t even have to leave your house.

💶 Which groups of people would benefit from having an account?

This very payment service would be particularly useful for freelancers, entrepreneurs, startup founders, as well as those who travel and lot and shop online.

💷 Are there any fees and commissions on internal transactions?

All the internal transactions (from one Payoneer account to another one) are free.

💵 How can I get a card and how much does it cost?

You can apply for a card in your account and receive it by mail. This service is free but you’ll have to pay $ 29.95 per year for your card service.

Please take a moment to pin this post to Pinterest

- Creative Burnout

What are your concerns?

Thanks for your response!

Disclosure: MasterBundles website page may contain advertising materials that may lead to us receiving a commission fee if you purchase a product. However, this does not affect our opinion of the product in any way and we do not receive any bonuses for positive or negative ratings.

Before starting this very article, I did my research on this topic as well as tested out this payment method myself. So the article is based on the data form the following resources:

- “How Does Payoneer Work.” Payoneer, www.payoneer.com/resources/payoneer-account/. Accessed 20 Apr. 2020.

- “How to Sign Up to Payoneer.” Payoneer, 2018, www.youtube.com/watch?v=1TiGifZGT-o. Accessed 20 Apr. 2020.

- “Payoneer Review: 8 Things You Need to Know Before Sign Up.” TRANSUMOADMIN, 2019, transumo.com/payoneer-review/. Accessed 20 Apr. 2020.

- Robertson, Amanda. Payoneer: The Best Method To Receive And Make Money Online. Kindle Edition, 2016.